by Margaret Smith, CPA | Dec 27, 2019 | Financial Planning

Attached we have highlighted the key provisions

The final weeks of 2019 brought the second major

piece of tax legislation in the past 24 months, as the SECURE Act (The Setting

Every Community Up for Retirement

Enhancement Act), which was passed in the House over the summer,

finally made its way through the Senate and was signed into law by the

President. The legislation may have significant repercussions for individuals

engaged in retirement and estate planning.

by Margaret Smith, CPA | Oct 25, 2019 | Financial Planning

Since 2006, IRA owners who are at least 70 1/2 can make a Qualified Charitable (QCD) of up to $100,000 directly from their IRA to a charity without having to include the distribution in taxable income. As a result of the late-2017 tax law passed by Congress, the Tax Cuts and Jobs Act (TCJA), the OCD strategy has become even more valuable to taxpayers.

Please click here to read more about this strategy

by Noah Greenbaum | Oct 22, 2019 | Financial Planning

Canal Capital is Pleased to announce that it was named to the RIA Future 50 list published by CityWire USA. The RIA Future 50 firms represent a group of finance professionals who are collectively creating this new investment landscape. They have their own unique story to tell, are driven to succeed on their own terms and, most importantly, are in charge of their own investment decisions.

Click here to see the full list

by Neil Gilliss, MBA, CFP | Oct 22, 2019 | Investments, Newsletters

As investors continue to grapple with the near-term issues impacting global markets, we believe there is disruptive innovation happening simultaneously and could be the transformative innovation platforms that can drive the economy out of a potential recession and power growth for many years in the future. The key areas are (Source: Ark Investments):

- Artificial Intelligence

- Robotics

- Energy Storage

- DNA Sequencing

- Blockchain

Please Click Here to Continue Reading our 3rd Quarter Market Commentary

by Neil Gilliss, MBA, CFP | Aug 21, 2019 | Investments, Newsletters

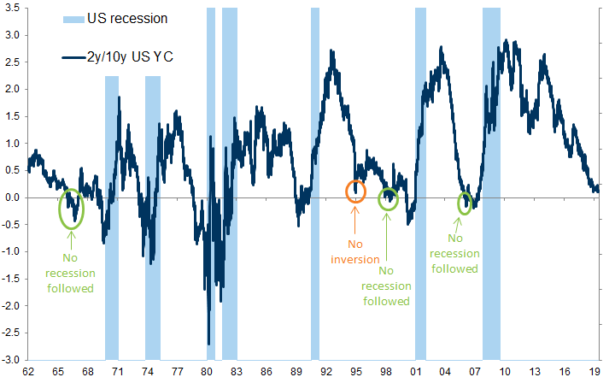

On August 14th, the 10 year Treasury Yield went slightly below the yield for the 2 year Treasury, the first time this has happened since 2007. Economist pay close attention to the 10 year vs. 2 year Treasury yields, as its historically been a strong predictor that a downturn is on the way. The yield curve has inverted before every US recession since 1955, although it sometimes happens months or years before the recession starts. The average time between the last 5 yield curve inversions and a recession was 17 months. This lead time is the key and its still very uncertain how long a lead time we may have in the current economy before there is an actual recession. That said, an inverted yield curve, like most other indicators, is not perfect and doesn’t mean a recession is imminent.

Please Click Here to Read our Full Commentary